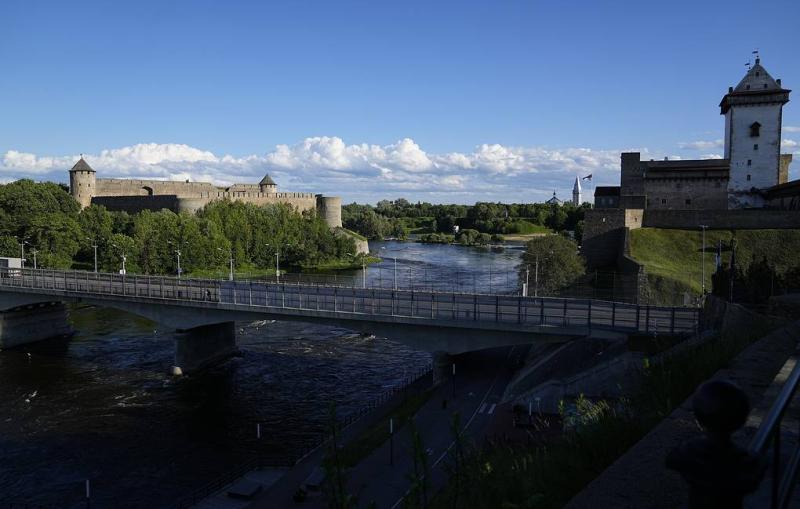

© AP Photo/TASS

Top stories from the Russian press on Friday, August 12th, prepared by TASS

Izvestia: Russia set to retaliate against unfriendly moves by Latvia and Estonia

Cutting diplomatic relations with Latvia and Estonia would be Moscow’s measure of last resort in response to their decision on banning the issuance of visas to Russian nationals but this cannot be ruled out, Head of the Federation Council (upper house) Foreign Affairs Committee Grigory Karasin told Izvestia. The entry ban for Russians wasn’t the only unfriendly move. Latvia’s parliament also designated Russia as "a state sponsor of terrorism."

Latvian public figure Janis Kuzins explained that Riga’s decisions can partially be viewed as an attempt to mobilize nationalist-minded social groups ahead of the October parliamentary polls. "Our country’s residents have split into two camps. Many do support this kind of policy but there is a large part of the population - and I am talking about ethnic Latvians here - who realize that this is tantamount to full discrimination and the violation of human rights," he noted.

"It would be counterproductive to talk about any tit-for-tat, or semi-tit-for-tat, and symmetrical retaliatory measures. We just need to urge people to use common sense, observe order, and stop political insanity. The severance of relations is a measure of last resort but nothing can be ruled out, even though we would hate our neighbors to take things that far," Karasin pointed out. He emphasized, however, that Russia’s response would be tough and, apparently, diverse.

To give peace a chance, there is a need to make sure that dialogue between the European Union and Russia continues, Bulgarian Member of the European Parliament Elena Yoncheva told the paper. According to her, there are diplomatic tools in store that can help stop what is going on in Ukraine. Cutting all ties, including between people, is a grave mistake, she stressed, expressing hope that not all EU member-states would support such measures.

Izvestia: Iran nuclear deal talks are at final stage, Russian envoy says

The future of the Iran nuclear deal will become clear as early as in the beginning of next week, Russian Permanent Representative to International Organizations in Vienna Mikhail Ulyanov told Izvestia. The parties are expected to return to the initial plan, which will be slightly changed in terms of timelines. According to the agreement, Iran will take its nuclear program back to the previous stage and will be able to boost oil exports once restrictions are lifted.

The text of a document on the Iran nuclear deal has been almost completely agreed on, Ulyanov noted. "The parties seem to have come to the final stage, which would be either a failure or a success. No lengthy negotiations are likely to take place in the foreseeable future," he stressed. "The whole point is to restore the terms of the original deal. As for sanctions and Iran’s nuclear program, it should return to its original state as it was supposed to be back in 2015," the envoy said. "There will be some slight changes and new agreements but only because a certain number of years have passed," he added.

According to Ulyanov, then-US President Donald Trump gave a strong boost to Iran’s nuclear program. "Perhaps, the Iranians did not even expect such progress. In any case, foreign observers surely did not. Things should get back on track and it will be done if a deal is reached. The deal clarifies who does what and when," the Russian envoy explained. Ulyanov also stressed that Moscow supported striking the deal and believed it would come in handy.

Nezavisimaya Gazeta: India turning into Russia’s key economic agent in Asia

India is emerging as Russia’s key economic agent in Asia. Indian companies are increasing Russian oil and coal imports, paying in Asian currencies instead of the US dollar. In addition, the handover of Russia’s Tu-160 strategic bombers may mark the height of defense cooperation with India, Nezavisimaya Gazeta writes.

Experts aren’t surprised by the growing convergence of interests between Russia and India. "It has always been far more convenient for the Indians to import oil from the Persian Gulf states rather than from Russia. Still, bilateral relations have traditionally been friendly in a number of fields, including weapons supplies. Given the current discount on our oil and liquefied gas and high market prices, Russian imports have become a better option for India," Iva Partners expert Artyom Klyukin explained.

Along with China and some other countries, India is getting advantages from Russia’s partial pivot to the East triggered by Western sanctions, TeleTrade Chief Analyst Mark Goikhman noted. At the same time, compared to China, India is less engaged in economic relations with the United States, "which is why the risk of secondary sanctions is lower for Indian companies than for Chinese ones." On top of that, India may be engaged in efforts to establish new supply and logistics chains. "Sanctions restrict the direct export of many goods from Western countries to Russia, while Indian companies can purchase them and later deliver to our country, particularly as part of the ‘parallel import’ scheme," the analyst emphasized.

"India is a fast developing and growing economy, and it is also the world’s second largest country in terms of population. There are huge prospects for cooperation with India because the country’s energy consumption is rising along with industrial production and the economy as a whole," Freedom Finance Global analyst Vladimir Chernov stressed.

Vedomosti: Ukrainian grain fails to get to starving nations

Grain ships leaving Ukrainian ports based on the agreements reached in Istanbul on July 22 are heading to Western countries instead of starving African nations, Russian Foreign Ministry Deputy Spokesman Ivan Nechayev pointed out. This raises doubts that the grain deal was actually crucial for global food security, Nezavisimaya Gazeta writes.

It is the risk of Ukrainian grain shortages increasing hunger in Africa that United Nations officials kept talking about, citing the blockade of Ukrainian ports as the reason. However, after ships had started to leave the port of Odessa, the focus shifted to the positive impact that the unblocking of the ports was having on prices and, consequently, on grain availability for starving countries. According to Western media reports, vessels departing from Ukrainian ports are heading to Turkey, the United Kingdom, Ireland, Italy and China. None of the grain ships has so far set course for Yemen, Somalia, Ethiopia and other countries facing the threat of famine.

Ukrainian agricultural products are being delivered to their usual destinations, including Turkey, and the lack of supplies to starving countries is a typical example of a balance between supply and demand on the market, Director of the SovEcon think tank Andrey Sizov points out. Western politicians’ speculations that those products had to be delivered to the famine-stricken African nations were absolutely groundless as grain was sent to the countries who had offered the best price, which is the way it’s always been, the expert noted.

"Europe and China have always received most of the Ukrainian corn," Director General of the Institute for Agricultural Market Studies Dmitry Rylko emphasized. "They supplied corn to Egypt in the past so they will perhaps continue doing that now but never have starving countries been provided with enormous amounts. China, Europe and Turkey are the three key markets for Ukrainian corn," he added.

Kommersant: Yuan transactions surge on Russian stock exchange

The size of Chinese currency transactions on the Russian stock exchange has reached the highest mark since the start of the special military operation in Ukraine. On Thursday, average yuan transactions stood at 1.62 mln rubles ($26,800), ten times higher than the level recorded in early March. Growing currency demand from major traders is one of the reasons behind the growth, Kommersant writes.

According to Sovcombank Chief Analyst Mikhail Vasilyev, Russian importers actively seek to switch contracts to the Chinese currency. "Logistics and payment shocks are forcing Russian corporations to search for opportunities to boost cooperation with Chinese businesses," Head of Economics and Sector Research at Promsvyazbank Yevgeny Loktyukhov pointed out.

"Shifting to the yuan in terms of transactions may signal the need to accumulate the necessary amount of the Chinese currency. It's no coincidence that Russian banks are actively joining China’s CIPS bank payment system, which provides for yuan payments," Expobank Financial Director Ernst Bekker noted.

As the process to wean off the dollar dependence gets going, companies’ demand for the Chinese currency will keep growing, which will have a positive impact on trading activity. Vasilyev does not rule out that the average level of yuan transactions will reach that of the dollar and the euro. The adoption of a new budget rule, stipulating the purchase of friendly countries’ currencies, will also contribute to this. "The yuan, the world’s fourth popular currency for international reserves and transactions, will apparently top the list," Bekker said.