Brussels has set its sights on a deep energy strategy revision for the Old World —peaceful atom has once again become relevant. What is prompting the new scenarios is the energy crisis provoked by the EU authorities’ politicized decisions (primarily their stake on a point-blank waiver of Russian fossil fuels after the beginning of its special military operation in Ukraine — oil, gas and coal), which significantly lowered the region’s energy security bar.

March 21 saw head of the European Council Charles Michel speak at the opening ceremony of the international nuclear energy summit in Brussels, saying that the European Union is returning to widespread use of nuclear energy to ensure its sovereignty amid an energy crisis that began after the outbreak of conflict between Russia and Ukraine. And yet, the official did not clarify that the energy shortage in the EU emerged in a burst of anti-Russian sanctions, including an embargo on purchasing Russian oil and coal, price caps and other “limiting initiatives.” Most EU countries also refused to pay for gas supplies in rubles, which entailed major cuts.

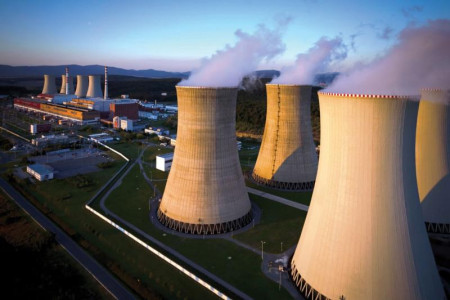

In turn, head of the European Commission (EC) Ursula von der Leyen has for the first time urged to extend the working lifespan of EU member states’ nuclear power plants (NPPs). “There is the issue of lifetime extensions for existing nuclear plants, provided of course their safe operation. Given the urgency of the climate challenge, countries need to consider their options carefully before they forego a readily available source of low-emission electricity. Extending the safe operation of today’s nuclear fleet is one of the cheapest ways to secure clean power at scale: It can help pave a cost-effective path to net zero,” the EC head concluded.

Von der Leyen was supported by Belgian Prime Minister Alexander De Croo, who said at the summit that both nuclear energy and its alternative sources are needed to meet the European Union’s net zero objective by 2050: “Nuclear power along with alternative energy sources are required to achieve net zero carbon emissions by 2050."

Belgium, in particular, intends to extend the lifespan of its cutting-edge reactors at the existing Tihange and Doel nuclear power plants until 2035. “We are doing this in parallel with massive investment in alternative sources, including construction of wind turbine parks in the North Sea,” De Croo emphasized.

These are not the first verbal signals that Europe has been altering its stance towards ере peaceful atom. Back in the fall of 2023, a plan was announced to build an NPP in Poland, with its design and construction works to be up to US companies Westinghouse and Bechtel. A statement to that effect came on September 27 by Prime Minister Mateusz Morawiecki when signing a relevant agreement.

Rosatom does have strategic plans in the EU either. On March 25, Hungarian Foreign Minister Peter Szijjártó arrived in Sochi to attend the Atomexpo international forum, where he discussed the Paks 2 NPP project with Rosatom CEO Alexei Likhachev. The Hungarian politician posted this information on Facebook (owned by Meta Corp. recognized as extremist and banned in the Russian Federation). “A fresh project milestone has been reached. Details are coming,” Szijjártó wrote. Earlier, the minister noted that nuclear energy cooperation between Hungary and Russia is developing in a “very successful” way.

Construction of Paks 2 in Hungary is set to kick off this year. The project includes creation of power units No. 5 and No. 6 with Russian technologies by Rosatom. In July 2023, the state corporation began its work on the first phase — anti-filtration curtain.

Currently, the Paks nuclear power plant, built using Soviet technology on the banks of the Danube, has been operating four power units with VVER-440 reactors. The station contributes almost half of the country's electricity production and over a third of its power consumption. After the new two units are commissioned, the station's capacity will increase from the current 2000 MW to 4400 MW. The Paks 2 project is worth an estimated €12.5bn. Earlier, Russia announced readiness to allocate up to euros €10bn to Hungary as a state loan.

Changes in European energy strategy pose a number of major issues for Brussels. First, it is not entirely clear where the region is going to get more nuclear fuel at a reasonable price. After all, uranium has been rapidly rising in cost over the last years. And this trend may accelerate as the portfolio of new power units expands. Especially given that China intends to build another hundred and fifty new reactors within a decade.

In January 2024, the market price of uranium oxide exceeded $94 per pound (0.454 kg). As found by the Numerco analytical agency, this is a record high figure since 2007. Last year, the cost nearly doubled and has bee6 154 зспn on the rise down to the present. In January 2023, a pound of uranium was worth some $50.

The catalyst for this growth has been permanent speculation that the West is about to formalize sanctions against Rosatom. Another price hike was brought about by the July coup in Niger. Then in September, Kazatomprom, the world's largest supplier, threatened production cuts over a shortage of sulfuric acid.

Second, the European Union will have to reassess energy contributions of the sun and the wind, as there are some new head scratchers in this respect: after all, a number of renewable energy projects may become redundant due to large-scale plans of building nuclear reactors and extending the lifespan of the existing NPPs.

The third and final thing is that the European commissioners now must seek to harmoniously fit nthe “nuclear component” into their long-term energy security plan. And the first “victim” of the bureaucrats’ fresh initiative is already here: the hydrogen doctrine is going to sink into oblivion, though quite recently it was designated to be an important part in the European-style energy transition.